|

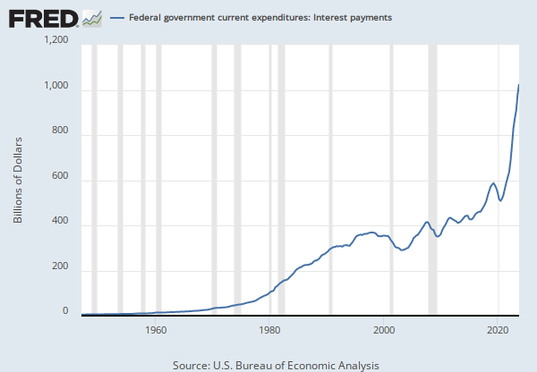

I honestly was considering a title of “How to see the asteroid before it hits earth”, maybe a poll of readers can come up with some pithy series title. So, as I watch our “elected leaders” do what they do, and I will leave that up to the reader to label their actions, I have to wonder, does anyone see the Déjà vu moment when it comes to spending and the cycle of bubbles, and say, hmmm I’ve seen this playbook before? So, here is one of the first in a long series of Charts I will show, pictures always provide more perspective than the babble from some politician. So, I will leave you for now to ponder what you are really seeing unfold before your eyes. I have many new and exciting things to describe while we are on our journey to the Sun, things like “The Repo Market” Yes, there is something in big finance called the Repo Market and the Feds statement says it all. “The Repo Market” Short for repurchase agreements, the repo market is a complicated, yet important, an area of the U.S. financial system where firms trade trillions of dollars’ worth of debt for cash each day. The activities on this market keep the wheels turning on Wall Street and the broader economy.

And go figure… I was silly enough to think this had something to do with an unpaid auto loan. Well folks, it’s a beautiful Saturday, I will go enjoy the Sun while it’s far enough away not to melt my clothes. It reminds me when all the smart people said, nothing to see here, yes, it’s possible that your lawncare guy can afford a house, and if he can’t, we will force the banks to afford it and the taxpayer will pay for it. Yes, those days when congressional testimony was like Saturday morning cartoons, see the Chairman of the Banking Committee Barney Frank assuring all us neophytes that all is well, they have everything under control. (This is a must you watch them entirely to understand just how smart are “leaders” really are) https://www.youtube.com/watch?v=LPSDnGMzIdo https://www.youtube.com/watch?v=hxMInSfanqg Now that we have been jarred from are post Covid haze, let’s start to compare those sixth sense feelings of yesteryear to todays current Bull Market and everything is just fine, minus Inflation, shrinking job numbers, and the invasion of the nation.. I’ll stick with the current economic nightmare, not to confuse anyone with the other dozen nightmares we face. If you are like me, I would like to know, what does the balance sheet really look like for the nation? Is the interest on the debt even considered, or is it just like all the other numbers they fiddle with in Washington DC, just a word like a Billion or now Trillions. I really like how they use the words, because if they had to publish the numerical representation, that might be alarming to some average taxpayer, like $1,000,000,000,000.00 or 1 Trillion… I think you know the answer. So as I lift the soiled carpet of Government, I see all these funny charts, they remind me of those good old days of shooting bottle rockets on the 4th of July, you just never really know where they were going, only that they were going somewhere fast, and eventually crashed.

1 Comment

Otto Krauss

4/2/2024 09:51:00 pm

Looking at the interest payments passing $1 trillion, it's almost like our politicians are trying to intentionally crash the economy, while at the same time systematically stealing purchasing power from everyone.

Reply

Leave a Reply. |

AuthorWrite something about yourself. No need to be fancy, just an overview. ArchivesCategories |

RSS Feed

RSS Feed